We prepare your tax return* and advise you in English and other languages!

As an employee or pensioner, you can become a member and pay nothing more than an annual membership fee of between €52 and €375 for personal and individual advice.

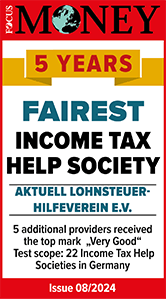

It’s just that simple: